Moody’s Investors Service, the reputed international rating agency, has pointed out likely emerging weaknesses in our economy.

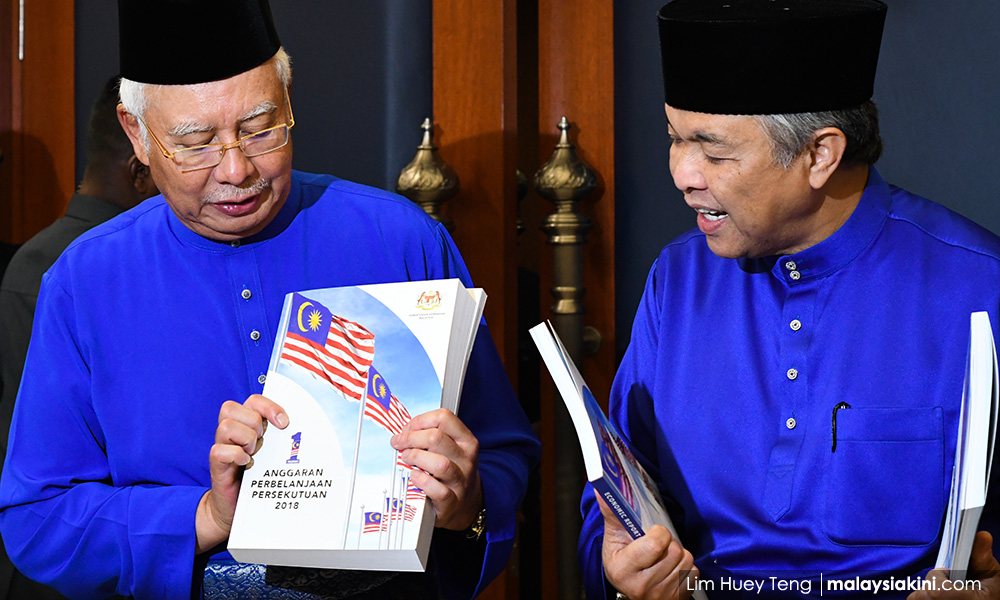

This warning has come close on the heels of the Budget 2018 speech made by the prime minister last week. Moody`s Investors Service has given us a rating of A3, with a stable outlook, which is good, except for the fact that it issued the following warnings.

Moody’s is not optimistic that the Budget forecast of between five and 5.5 percent growth will be achieved, believing the former figure is more likely.

This lower rate of growth projected by Moody’s means that there will be some slowdown in economic activities, implying lower incomes and higher unemployment.

Moody’s cautions that our budget revenues as a share of our GDP is among the lowest in its rating category of A3, highlighting the fact that the Budget 2018 had no new tax proposals.

We are thus depending on just natural growth of revenue, which are estimated to continue to decline to 16.6 percent in 2028 from 21.4 percent in 2012. This is not healthy. Should we tax the higher income groups more?

Even this lower proportion of tax to GDP may not be realised, as commodity prices and the world demand for our exports may not rise as much as expected. What if commodity prices decline to lower than our projections, such as for oil and gas and palm oil?

On the other hand, budget expenditures have been significantly raised in the so-called election budget, especially with regard to the operating expenditure, while still maintaining high development expenditure.

The budget could therefore come under considerable strain. The struggle to achieve the budget deficit target of 2.8 percent of the GDP could therefore be very challenging for Budget 2018.

The debt, which is now estimated at 51.5 percent of GDP for 2018, could rise further to finance a worsening budget current account deficit. Already, Moody’s warns that this debt rate is much higher that the A- rated median of 40.9 percent for 2017.

Is this a warning telling us to be more careful, lest we get downgraded by Moody’s, from the current rating of A3 to something lower ?

The Moody’s report on our economy is analytical and frank. It raises some red flags as to what our budget and economic weaknesses are, and the challenges we face.

It is good that we have independent and competent international rating agencies as well as the World Bank and IMF, giving us objective, if sometimes too subtle advice.

Hopefully, we will take heed and be guided by their views, taking into account our own concerns, and act accordingly. Nevertheless, we shouldn’t run these red lights, or risk serious danger.- Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.