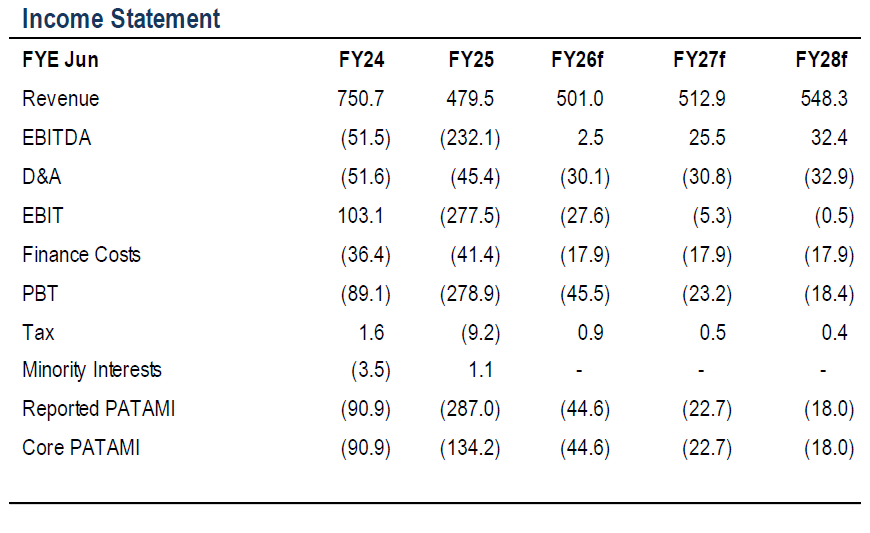

BFood’s quarter two financial year 2026 (2QFY26) revenue of RM126.3 translated to core loss after tax, amortisation and minority interest of -RM10.6 mil.

The results missed both Hong Leong Investment Bank’s (-RM44.6 mil) and consensus (-RM46.8 mil) expectations, primarily due to weaker than expected sales at Starbucks and a slower pace of demand recovery.

While losses continued to narrow, earnings remain firmly in the red, extending the group’s loss making streak.

Group revenue declined -2% QoQ to RM126.3 mil, driven by underperformance in Malaysia (-2%), which more than offset growth from other SEA markets (+35%).

The weakness in Malaysia reflects the ongoing Starbucks boycott since Oct-23 following the Israel–Gaza war, which continues to materially suppress traffic and sales.

Growth in other SEA markets was supported by contributions from newly opened Paris Baguette outlets in the Philippines.

“Despite the sequential narrowing of losses to -RM10.6 mil, we believe a return to profitability will take time given the still challenging demand environment,” said HLIB.

Top line improved by +3% year-on-year to RM254.5 mil, largely driven by overseas operations. This offset lower revenue from Malaysia following the closure of underperforming stores.

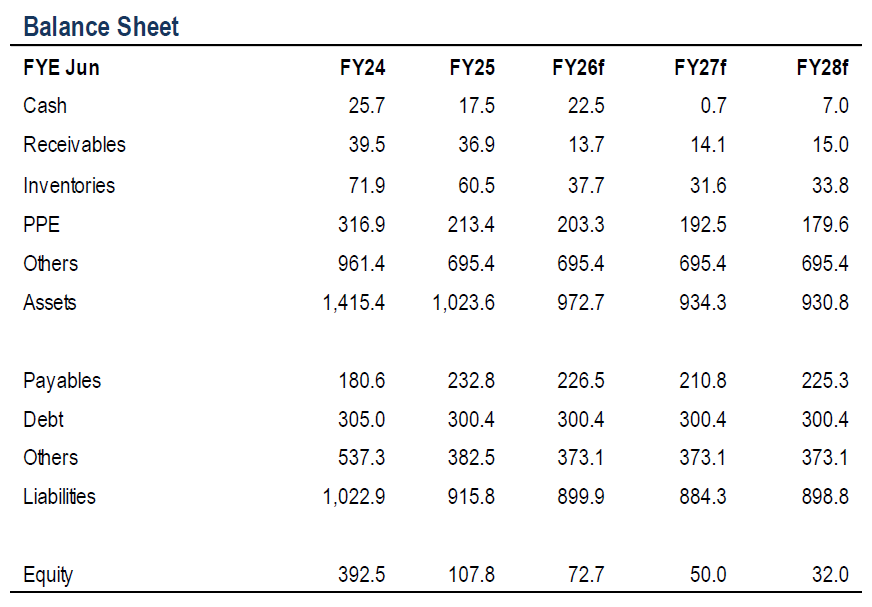

Losses narrowed to -RM26.8 mil in the first half of financial year 2026 (1HFY26) from – RM69.0 mil in 1HFY25, supported by cost-saving initiatives, store rationalisation, and lower depreciation and amortisation charges.

That said, the improvement remains largely cost-driven rather than revenue-led, underscoring the fragility of the recovery. Management continues to prioritise footprint optimisation as part of its operational reset. Starbucks Malaysia’s store count declined to 267 outlets following 20 net closures in 2QFY26, while KRR and Paris Baguette stood at 27 outlets (ten closures) and 17 outlets (one addition), respectively.

While management is considering selective Starbucks expansion (10 smaller-format stores), the overarching focus remains on consolidation, operational efficiency, labour productivity, and disciplined marketing.

“We expect the lingering brand overhang from geopolitical tensions to continue weighing on BFood in the near term, delaying any meaningful recovery toward pre-boycott performance levels,” said HLIB.

At the same time, intensifying competition from rapidly expanding local and China-based coffee chains is structurally raising competitive pressure, further constraining Starbucks’ ability to regain lost market share. Overall, earnings visibility remains low, with no clear catalyst to drive a sustained turnaround. —Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.