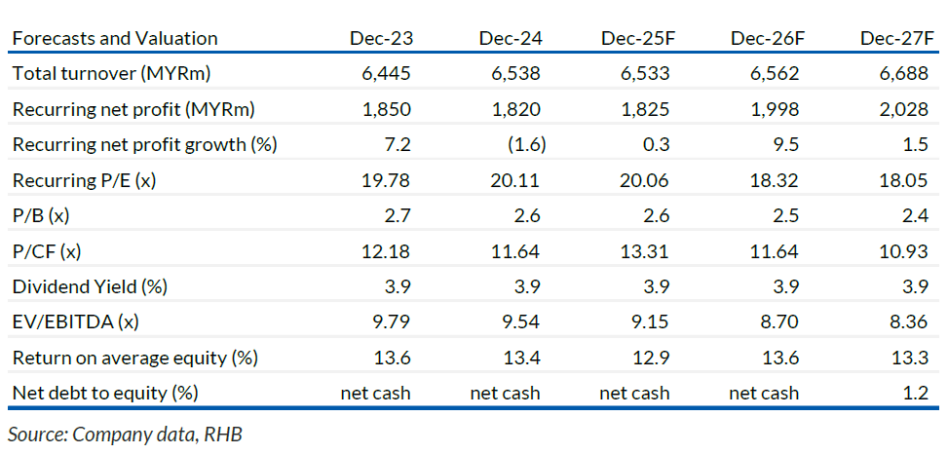

RHB believes Petronas Gas (PTG) is fairly valued to reflect the 5% base tariff hikes for its regasification and gas transportation units.

“We have also factored in lower gas costs, and identify a 4% upside from new regassification terminal project,” said RHB.

This report marks the transfer of coverage to Max Koh. Last month, the Government announced new Regulatory Period 3 (RP3) tariffs for PTG’s regasification and gas transportation divisions. “The new allowed tariffs translate to a 5% average hike – which met our expectations. We have factored in the new tariff adjustments into our model,” said RHB.

RHB believes PTG is likely to build a third regasification terminal (RGT3) in Lumut, as previously indicated by its major shareholder Petronas. Last week, Petronas had also signed an agreement to procure LNG from QatarEnergy for 20 years.

“We believe the RGT3 award will be announced this year as it would take 2-3 years to construct the terminal to meet the targeted commissioning in 2029-2030. The RGT3 is intended to meet gas demand from 6-7GW new gas plants in 2030,” said RHB.

Assuming PTG builds a 990 mmscfd capacity, RHB estimates a 12% project internal rate of return, and a 77 sen accretion upside from their target price.

Malaysia Reference Price (MRP – weighted average price for exported LNG, which determines the prices for PTG’s internal gas costs) has reduced 44% from its peak in 2023, in tandem with the 37% decline in Brent oil prices.

As RHB expects Brent oil price to fall 9% this year and coupled with a stronger MYR vs USD, they forecast MRP to decline 15% and 6% in the year 26-27. This translates to 1-2ppt net margin improvements in the year 26-27.

After imputing RP3 tariffs and lower gas cost assumptions, RHB adjusted their FY25-27 earnings per share by -3%, 5%, and 7%.

“We maintain our NEUTRAL recommendation,” said RHB. Lower gas cost is a key upside risk while key downside risks include carbon tax implementation and higher gas costs. —Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.